Julian H. Casal, ESQ.

MIAMI ESTATE PLANNING ATTORNEY | CASAL & MORENO, P.A.

As Managing Partner of Casal & Moreno over the past decade, I have cultivated a practice that focuses on estate planning and commercial transactions. My experience in and knowledge of these areas of the law are indispensable to my clients’ success—with the tools and guidance my expertise provides, they can acquire and accumulate wealth without worrying whether they will have anything to leave to future generations.

People Who Work with Me:

I work with business professionals and their families, from business owners, CEOs, and executives in Miami and South Florida to entrepreneurs and foreign investors with international interests.

The clients who retain my services typically fall into four categories:- Visionaries who have found success in business but have not yet prepared their business or estate with the proper legal documentation.

- Small business owners and service professionals who are growing their businesses and are concerned about protecting their families in the event of their death or incapacitation.

- Foreign investors who have come to the US to start a business, invest in US markets, or buy real property but need help navigating proper business structuring and other legal obstacles to strategically lessen their tax burden.

- High-net-worth families and estates that need guidance to structure inheritances in the most efficient way possible for the next generation.

How My Services Help:

- Establish a will or trust to prepare for the future of your business and ensure the financial well-being of your family.

- Ensure your wishes are carried out regarding the distribution of your estate’s assets.

- Create an advanced directive—such as a durable power of attorney, living will, or health care surrogate designation—to ensure your wishes are respected in case of incapacitation.

- Navigate the estate implications of coming to the United States as a foreign national to start, buy, or sell a business, or invest in real estate.

- Put business succession planning strategies into place to make sure your business continues to operate should something happen to you.

- Institute wealth transfer strategies for the most tax-efficient ways to make gifts and pass assets to family members, relatives, and charitable causes.

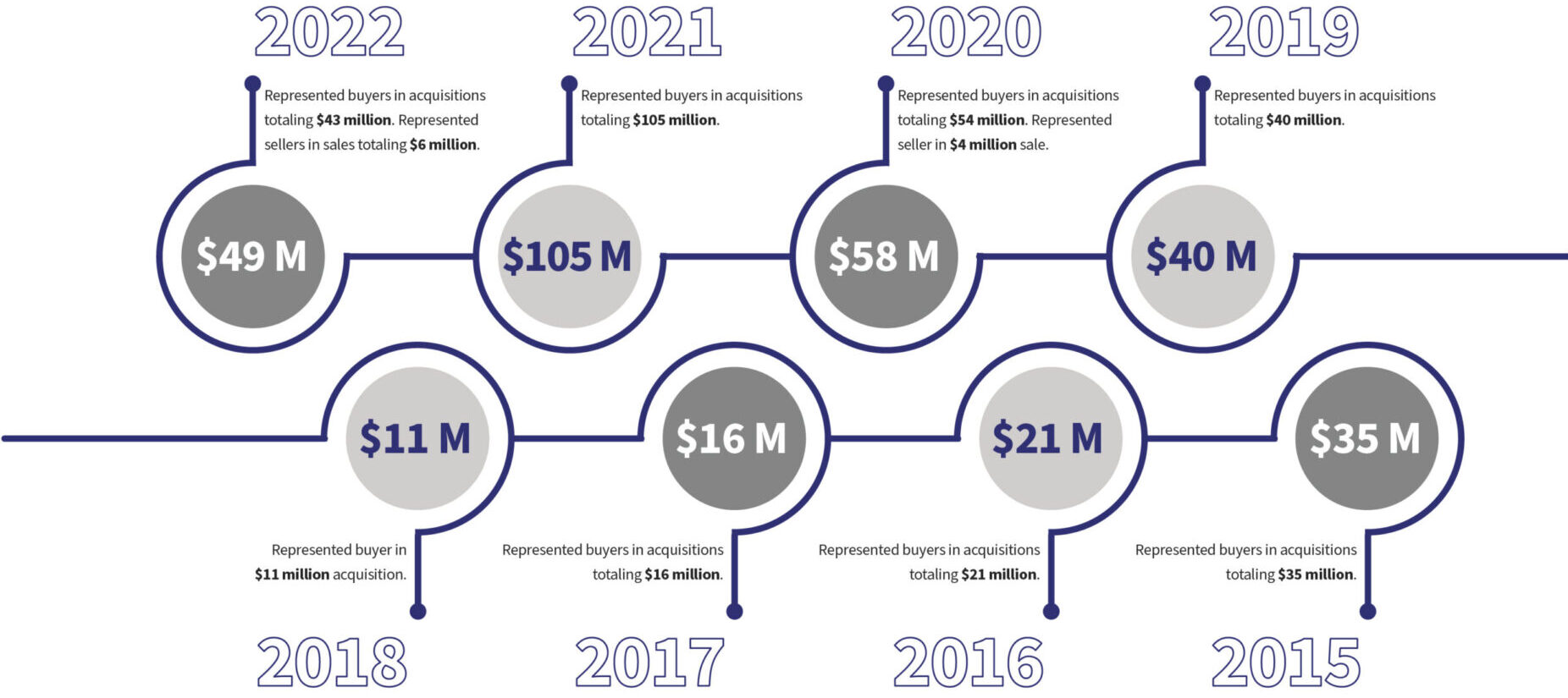

- Acquire or sell commercial property, including but not limited to commercial centers and properties with national credit tenants, owner-occupied settings, and multi-family properties. (For a summary of the commercial transactions I have handled, see my representative work below.)

Casal & Moreno – Knowledgeable, Personable, Approachable

My law firm has helped hundreds of individuals and their families create a detailed plan for their businesses and assets and navigate a wide variety of legal situations.

With my expertise to guide you, you can structure your estate correctly, acquire and accumulate wealth efficiently, and build your business to be legally sound.

I am proud to cultivate a deeply knowledgeable yet personable and approachable atmosphere at Casal & Moreno. Despite the highly complex cases I have successfully handled, my aim is to be consistently informative, reassuring, understanding, and focused for my clients.